This post may contain affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a qualifying purchase.

Another year has passed since I quit my job and we became a one-salary family. And, just like for many of you, this past year was a doozy.

But it’s still important to take time each year to reflect on the good, the bad, and the ugly. Especially on a year like 2020. That’s how we learn and grow and continue in the right direction.

If you haven’t heard my story about why I quit, you can get the long backstory on my about me page. If you’re good with the cliff notes, then all you need to know is that my job stressed me out to the point of causing health issues and my elementary school teacher husband let me quit and prove that we could live on just his salary. He was willing to let me try, but I’m not sure he was too confident about it at the time.

On my one-year quitting anniversary, I reviewed our family budget, and the results proved that my efforts to budget within our new one-salary income every month was working! We didn’t dip into our savings, and we actually still saved money that first year.

Then I was able to replicate those successes in year two, despite even bigger unexpected expenses! Across those two years, we saved about $750/month.

So, in keeping with this tradition, I’m reflecting on the past year’s budgeting for our family and sharing it with you for the third time.

Life is a journey and I must continue to look back and evaluate our budgeting results to ensure we’re still on track. It’s an ongoing effort to make sure we can still live comfortably on just my husband’s teaching salary.

And when I’m done with this particular yearly review, I’ll be happy to put 2020 behind me!

Read on for year three of our family budget results, COVID edition!

Frugal Thumb Tip: Do a big full year review in addition to checking your budget weekly. I spend a few minutes checking our budget in Mint.com weekly and monthly throughout the year, but those checks only gives me a short-term month-to-month view. Doing a big full year review will give you a better long-term view of your budgeting progress or setbacks.

So, without further ado, let’s see how year 3 of my unemployment/retirement/blogging/stay-at-home-mom-ing (-I still don’t know what to call it) turned out.

Here are the questions I asked myself to gauge the answer:

- For each month, did we lose or save money? Overall?

- In Mint, look at the “Trends>Net Income>Over Time” report and filter by “Last Year.”

- What major life events–expected or unexpected–affected these outcomes?

- In Mint, look at the “Trends>Income>Over Time” report for savings and the “Trends>Spending>Over Time” report for expenses. Drill down as needed.

- Are our savings for retirement and college on track?

- In Mint, look at the “Trends>Assets>Over Time” report and filter by “All Time.”

- How well did we survive solely on my husband’s elementary school teacher salary?

- In Mint, scroll down on the “Trends>Net Income>Over Time” report and check out the “best month, worst month, greatest change, and average” info.

And, as always, the biggest question:

Were we still making ends meet or did I need to go back to work and get a paying job?

In this post, I’ll list our large and/or unexpected expenses, our large and/or unexpected savings, and then break it down with our monthly net income and net assets.

Note: When you see the numbers I’ve pulled for our monthly budgets, you might wonder how I keep track of all this budgeting information for our family. And the secret is Mint.com. I am able to easily track and review all these budgeting statistics solely because of mint.com. It’s a free website made available by Intuit, the same folks who make Quicken. And it aggregates most all of our financial accounts automatically. I highly recommend it. In fact, you can read my top 10 reasons to use Mint for budgeting and learn how to quickly set it up and start using it for tracking your budget in my Mint tutorial.

Large and/or Unexpected Expenses in the Past Year

As always, there are some large and/or unexpected expenses that come up over the course of a year. Year 3 of my quitting anniversary was no exception.

I’ve compiled a list of the bigger expenses that really cut into our savings.

I don’t like to call them budget busters… That makes it sound like the budget was busted beyond repair. I think budget stretchers is more accurate. When a large unexpected expense came up, we were flexible with the budget and made up for it in other budget categories.

So here’s the list of our main budget stretchers from January 2020 through December 2020 (12 months):

- Plumber: -$450

- Veterinary Bills for our two senior cats plus adoptions/vet care for two new kittens: -$3210

- Loss of Summer School Salary due to COVID: -$2100

- Disney World Trip that we didn’t get to take due to COVID: -$2547

- Gravel Delivery for pathway/patio projects: $275

- Dental Bills for My Broken Tooth: -$918 (and counting)

- Federal and State Taxes: -$464

- Hepa Air Filter for Husband’s Classroom: $270

- Vinyl Tiles for Basement Flooring project: $350

- Property Taxes: -$2320

- Christmas: -$753

Total: $13657

Unexpected Savings/Income in the Past Year

We had a few helpful bumps to our savings and income in the past 16 months as well, including:

- Enrolled myself in a more affordable health care plan: $1166 in savings ($97/month cheaper, down from ~$275/month)

- COVID-19 stimulus money: $2900

- Canceled my Beachbody membership in March: $1116 in savings (usually $124/month)

- No Sporting KC season ticket: $1000 in savings (We didn’t have to pay for the complete season because… COVID.)

- No After School Program: $1750 in savings (usually $250/month or $2500/yr)

- Blog ad income: $355 (It’s the first year I made money! Not quite a dollar a day, but I’ll take it. Haha!)

- Salary increase for husband: $780 ($65/month)

- Grandparents give ridiculously large monetary gifts when my sweet cat Macintosha passed away and again when my tooth broke: $3000

- Savings from cash back apps: $933 ($77/month)

- Lakeside Perks cash back: $665 (compared to $341 last year)

- Rakuten cash back: $121 (compared to $23 last year)

- Raise.com cash back/savings: $90 (compared to $420 last year)

- Ibotta cash back: $0 (compared to $122 last year)

- FetchRewards: $0 (compared to $9 last year)

- Microsoft Rewards (Bing): $15 (compared to $30 last year)

- ShopSmarter: $42

Total: $13000

It’s not exactly the same, but somehow, with all the turmoil of 2020, we still managed to be pretty even between our large and/or unexpected expenses versus our unexpected savings and income. It’s such a relief to see it like that. But it’s just a small part of the story.

Trying to compare all the unexpected stuff together is like reading random pages out of a book.

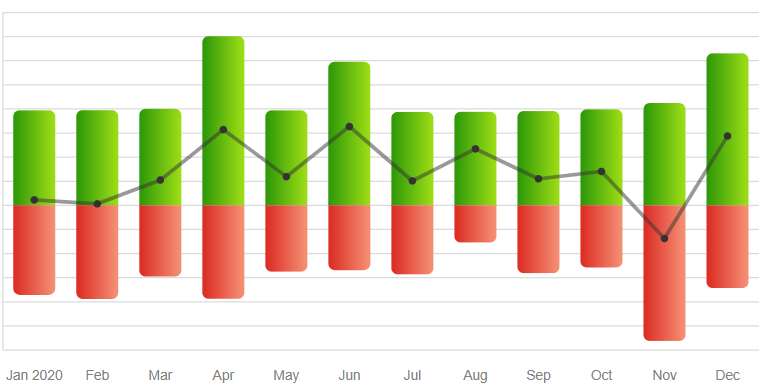

What does tell the rest of the story is our net income (in other words, our income minus expenses) for each month and our total net income for the whole year.

So it’s time to dig into that Net Income information and compare your income to expenses each month and overall for the year.

Of course, our net income is better in some months than others, and that’s totally normal. The important thing is if the trend is in the positive direction.

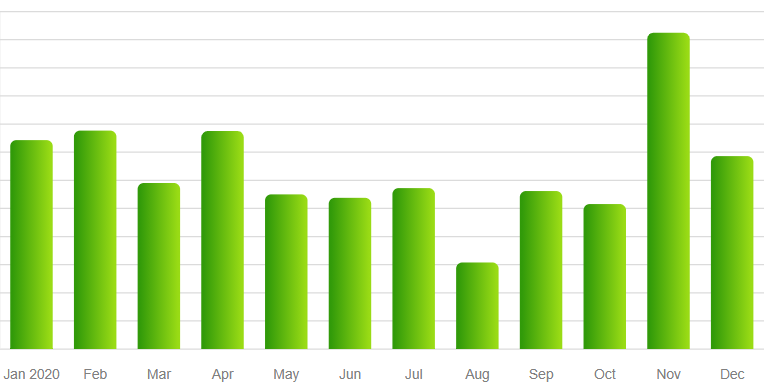

2020 Net income month by month

- January 2020, $226.65: We bought our plane tickets in anticipation of our summer trip to take my daughter to Disney World for her tenth birthday. *sigh*

- February 2020, $63.18: We bought our park tickets, magic bands, and t-shirts for our expected summer Disney World Trip. *double sigh*

- March 2020, $1,051.43: After we had some plumbing issues fixed in our guest bathroom, the next week, things shut down because of COVID-19, including schools. We were not able to get a refund for our plane tickets or Disney park tickets, but the expiration dates were pushed back at least. We have not started planning again yet. Concerned about budgeting, I bought a couple extra bags of Shakeology this month and then canceled my monthly shipments from Beachbody to save money. I started my seeds for the spring’s veggie garden.

- April 2020, $3,142.05: We started saving on after school care this month. But no tax refund from Uncle Sam this year–we owed money this time. Ironically, this is the same month that the government provided COVID relief for everyone so we got that back and more. We had zoom meetings with friends to play online games and started a daily exercise zoom with family. This is also the month that my previously healthy 13-year-old cat Macintosha started developing a neurological disorder. Many expensive trips to the vet later without a diagnosis (in April/May during COVID, no less), we decided to make Mac as comfortable as possible at home. It was that or pay thousands of dollars for them to do more tests and perform brain surgery.

- May 2020, $1,189.79: I got my first Google AdSense paycheck! We had more vet trips for Mac. I got a truck load of gravel delivered to the house to put in a gravel pathway on one side of our house, a retaining wall and pathway on the other side, and I re-graveled the patio. We started ordering our groceries online and doing curbside pickup for a full month’s worth of food at a time.

- June 2020, $3,269.19: After many days of laying in bed cuddling with Mac, we lost her to her illness. She passed away with all of us there with her. I still miss her everyday.

- July 2020, $1,014.52: We went on lots of family walks and bike rides around the neighborhood. I bought a laptop, but I immediately had to send it back for repairs. This was the month we watched the date go by when we would’ve been heading to Disney World. It was rough, but my daughter took it like a champ. She enjoyed a birthday zoom instead.

- August 2020, $2,342.18: Our family went to a magic show on zoom (Magic for Humans). We bought an air filter for my husband’s classroom in preparation for returning to work in person this month.

- September 2020, $1,101.74: I installed peel-and-stick vinyl tile in our basement. The previous basement flooring project was starting to peel up and it needed a change.

- October 2020, $1,404.50: We adopted two kittens from KC Pet Project! They have brought so much more joy to our home during COVID. It was a great decision for our family. We also liked the August magic show on zoom so much that we went again this month for Halloween, instead of trick-or-treating.

- November 2020, -$1,375.26: This is the one month of 2020 where we busted our monthly budget. We had to pay our property taxes. We also started buying Christmas gifts. And our senior cat got ill and needed an expensive surgery for kidney stones. Then one of my teeth broke and my dentist determined that I needed a crown. After getting the temporary crown, I had a tooth ache so painful that it required a root canal. Then they missed one of the root canals during the procedure so I had to have a second root canal to fix it. I’m hoping to be able to put this tooth problem behind me some time in January.

- December 2020, $2,875.45: Many years after Lasik, I needed to get glasses again this month. We also finished all of our Christmas shopping! I still use, love, and recommend the free app Santa’s Bag for tracking your Christmas spending. We had Christmas Eve and Christmas Day zooms with family for mass and opening gifts.

Net Income Total (for 12 months): $16,305.42

By dividing our total net income by the total number of months, I calculated that we saved $1359/month on average during my third quitting year. That’s nearly double what we saved each month throughout my first TWO quit-iversaries!!! ($750)

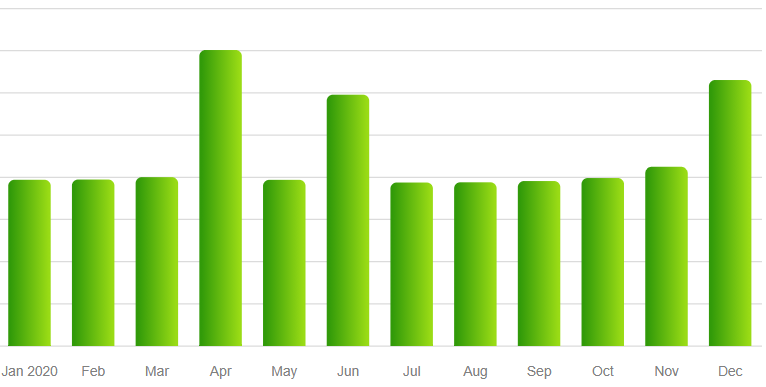

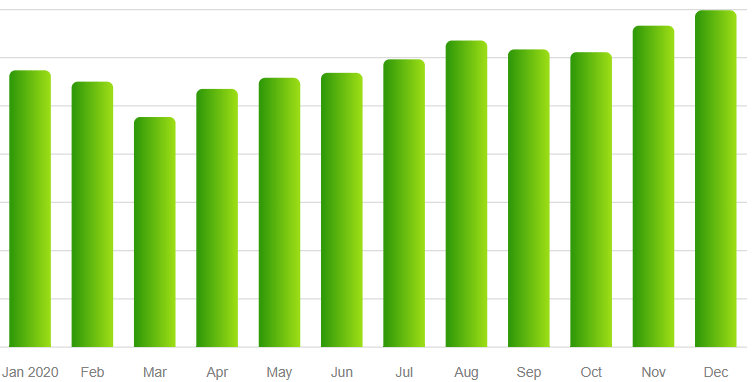

Net Assets

(Retirement Accounts, College Fund, Stocks)

Lastly, I took a look at our other investment accounts to make sure that we were still on track to save enough for college and retirement.

More good news! According to our Mint report, we were up about $124,000 over the course of the year. (To calculate this, just take the December Asset total and subtract the January Asset total to get your total saved for the year.) We stayed the course and continued to invest when the stock markets went down in February and March due to COVID-19, and it made all the difference.

We still aren’t putting in as much money each month as we used to, but our retirement accounts and college fund for our daughter continue to grow with interest. Yes, this is mostly all money that we can’t touch right now (without penalties), but we will some day!

Affordable college and comfortable retirement are still within our reach.

Our One-Salary Family Budget Results in a nutshell

It was another successful year of budgeting!

Our budget results showthat our net worth is $129,000 more than 12 months ago! (In Mint, look at “Trends>Net Worth>Over Time” and filter by “Last Year”.) That’s for two adults, one child, and three cats on just one teacher salary!

That’s almost TRIPLE the teacher salary. Mind blown. Again. ?

As you can see, not only did we make ends meet, but we still had some splurge buys, family fun AND continued to save for retirement, our child’s college, and emergencies.

After three years of living as a one-teaching-salary family, it feels good to know that we don’t need my old salary. We can continue to do this. Our budget results are proof!

Okay, I guess I’m a little less angry at 2020 now, maybe.

Despite the wonderful budgeting silver lining, good riddance, 2020! I’m happy to put you behind me.

If quitting your job and living as a one-salary family is something you dream about, you can make it happen too.

Don’t know where to start? Read my post here about making a budget. That’s the first step in reaching financial freedom- budgeting.

You’ve got to know what your money is doing. And then you can start telling it what to do.

2 comments

pretty incredible stuff! I am super excited for y’all. We have been trying to live on one salary since the wedding and paying down debt and hope that in maybe three years to be debt free (fingers crossed). Living in a tiny house with one bathroom and two large men, some days that feels less doable than others 🙂

Thank you, Abby! It took us 4 years to be debt free, and it has been awesome. Life changing to say the least. It sounds like you’re doing the things that will make it happen too. Reaching that goal will make it all worth it. You can do it!!!

I’m keeping my fingers crossed for you too.?