This post may contain affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a qualifying purchase.

Mint is getting rolled into Karma this month (January 2024) so it’s making me get my butt into gear and not procrastinate on doing my yearly budget review. Mint has been an amazing budgeting tool for me these past 11 years and I’m so bummed that it won’t be available anymore. I’ve downloaded my data so I have a backup of the last 10 years of transactions. And I’ll be checking out Karma soon. But from what I’ve read, there won’t be the same budgeting capabilities… At least Karma is free, I guess.

I have been doing some research on other budgeting tools out there, but I haven’t found one that’s both free AND as good as Mint. Lol. So far, my favorite has been the free online budgeting tools that are offered by my bank. So I recommend checking out your bank’s online offerings and see if yours also has free budgeting capabilities.

Now let’s dive into my family’s 2023 financials. After 2022, I’m really happy with how this year went!

Large and/or Unexpected Expenses in the Past Year

- March: Small Business: $600 – decided to officially name this blog and sell digital products

- April: Solar Panels: $7300 – final payment

- May: Termite Treatment: $525 – found termites in a wood pile in the backyard so had the house checked and treated

- September: Tree work: $1650 – for solar panels

- September – December: Vet bills: $675 – our cat Lucky’s recurring UTI issues

- October: Traveler’s Insurance: $1300 – for next year’s car insurance

- March & November: Taxes: $4000 – federal and state taxes, property taxes, and real estate taxes really added up this year

- December: Vacation: $1200 – visited family in FL

Total: $16,050

Unexpected Savings/Income in the Past Year

- May: Evergy Rebate: $1300 – for solar panels

- Cash Back: $600 minus $113 = $487 – from using cash back apps

Total: $1787

Net Income

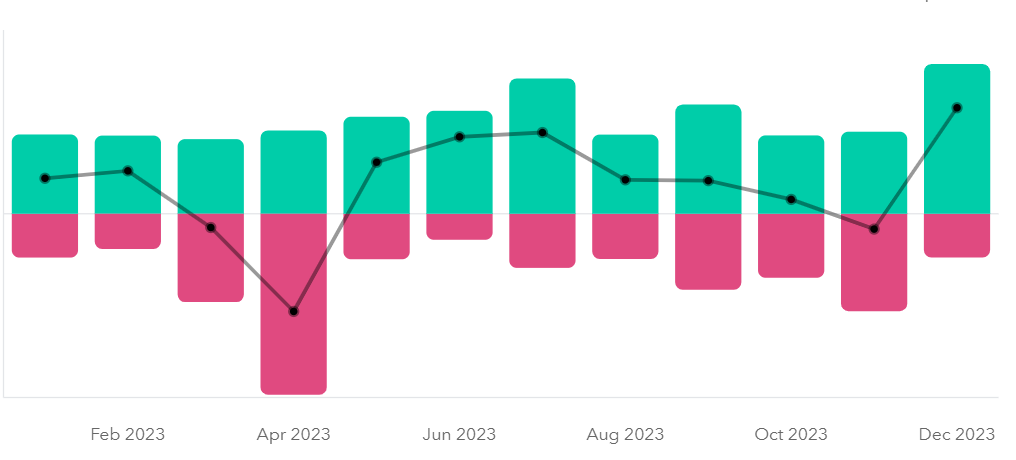

In Mint, I looked at the following report: “Trends>Net Income>Over Time” and filtered by “Last Year.”

Here’s a screenshot of our Net Income report:

The average saved was about $1100/month.

Income vs. Spending

$4250/month (because my husband also taught summer school)

$450/month in interest on savings accounts, reimbursements for HSA, and cash back apps

Total Income: $4700/month

Total Spending: $3600/month average spending

That average spending per month also includes all the large and/or unexpected expenses in it. Interestingly, if I remove the largest unexpected expenses, we would have spent $1000 less every month, for an average monthly spending of $2600. But, because of those unexpected expenses which always seem to pop up in different ways every year, our true average spend per month was $3600.

And I’m good with that. That number is still allowing us to save and prepare for the future.

Net Assets / Net Worth

(Retirement Accounts, College Fund, Stocks)

Speaking of the future, our investments continued to grow untouched in 2023. I took a look at our retirement funds, college fund, and stocks.

These accounts were up $142,000 in 2023 (after being down more than $50,000 in 2022).

🙂

I love being able to stay at home and still feel financially free after all these years.

I know I keep saying this, but I really do see budgeting as the reason I have the ability to stay home and not have a paying job on just my husband’s teaching salary. If I do go back to work, it will be my decision. It will be because I want to and not because I have to. That’s huge.

Budgeting is such an important life skill and can make the difference in whether you have the capacity to do what you want to do in your lifetime.

If you’re still not budgeting, please please please make it a new year’s resolution for your 2024!