This post may contain affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a qualifying purchase.

My last day working in the corporate world as a salaried employee was August 31, 2017. I can’t believe it’s already been a whole year!

That means I officially made it to my one-year quitting anniversary. My husband called it my “Quit-iversary” because he loves portmanteaus. ?

He has also been the sole breadwinner for our family this past year because of me. As an elementary school teacher, he was pretty concerned about this situation, and the added pressure on him to make ends meet for our family. But he was on board 100% when I quit my job for health reasons. I’m the luckiest.

Our family consists of two adults, one child, and two cats.

After one year, I decided it was time to crunch the numbers and take a closer look at our family financial situation since I left my job, and (hopefully) put my husband at ease.

I am the budgeter of the family and am always tracking our spending. By budgeting, I have a good feel for our finances at any time, but I wanted to revisit our budgeting in the past year and see how things shook out overall.

To gauge how this quitting thing was going, I asked myself a few questions:

- How was our budget doing month to month?

- Did we lose or save money? Monthly? Overall?

- What life events (expected and unexpected) affected these outcomes?

- How well did we survive solely on my husband’s elementary school teacher salary?

And the biggest question:

Was this new lifestyle sustainable or did I need to go back to work and get a paying job?

After digging into all of our transactions and budgeting from the past year, I’m happy to say that the last year has been a financial success – without my old paycheck!

Read on for more details about what I discovered on my one-year quitting anniversary.

When I quit my job, I honestly didn’t know if we’d be able to make ends meet with just my husband working. It was going to be close. I had estimated that, on the high end, we might cut into our savings up to $1000 per month as long as I wasn’t bringing in a paycheck. That wouldn’t be ideal, but it would give me some wiggle room to decide when I wanted to start looking for another job because we had a good sized emergency fund (that could last us a year if BOTH of us lost our jobs).

However, even with a few unexpected expenses throughout the year, we have made ends meet consistently, month after month, AND continued to save. WITHOUT my old salary.

By running reports on the data in my Mint.com account, I could determine some pretty close estimates on net income, assets, spending habits, net worth, and more!

Before I dive right into the final numbers themselves, I wanted to list some of the things that contributed to our budget results.

Large and/or Unexpected Expenses in the Past Year

- New-to-us car when my husband’s car was rear-ended and totaled (-$7,600)

- Property Taxes (-$2,400)

- Broken Cell Phone (-$75 plus $25/month for 10 months = -$325)

- Medical bills for mammogram and thyroid problems (-$1,800)

- Water heater breakdown (-$250)

- Blog/Blogger training course fees (-$1,200)

- Theme Park Family Season Passes (-$550)

- Sports Team Season Ticket (-$750)

- Big Birthday/Christmas Gift for my husband for letting me quit (-$800)

Total: $15,675

Unexpected Savings/Income in the Past Year

- My final paycheck/vacation pay ($3,025)

- Dog Walking/Cleaning house for a friend ($200/month for 4 months = $800)

- Tax Refund ($3,000)

- Summer School teaching salary ($2,050)

- Teaching salary raise ($350/month for 8 months = $2,800)

- Affordable Care Act Health Plan ($500/month for 8 months = $4,000)

- Note: I’m not including this in the total, but we paid off our house before I quit my job so we had no mortgage payment, which I estimate saved us nearly $700/month.

Total: $15,675

When I finished crunching the numbers for our big unexpected and expected potential budget busters and surprise income savers, I did a double-take. I couldn’t believe how close they were. My numbers are averages and not exact, but it’s close enough to realize that everything pretty much cancelled out in my lists of “make-or-break” life events throughout the last year.

I was not expecting that, but it was a relief for sure.

With that out of the way, I took a closer look at our net income over the year. That would show me how much we actually saved- or went over budget.

So how did everything shake out?

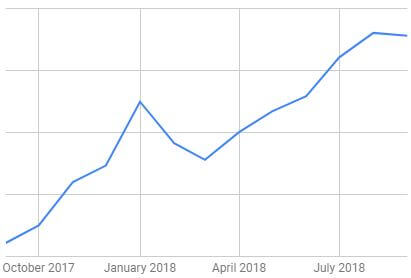

Net Income

Net Income Month by Month

I looked at our income minus expenses to get our net income each month through the year. There were months when we saved money and months when we spent more than we brought in.

- September 2017: $10,191 – We had my final paycheck/vacation pay this month, as well as reimbursement for my husband’s totaled car from the insurance. We also attempted our first Zero-Spending month which helped us save quite a bit more than usual.

- October: -$10,912 – We bought my husband’s new-to-us car and accessories. Ouch. But overall, the car has been a good investment so far. Honestly, it was a big blow to my hope that we could live well, or even survive, on one salary. I was very concerned that we couldn’t afford it long term. But we had our emergency fund so I didn’t want to give up yet.

- November: -$2,707 – We paid our property taxes and I got my husband a big birthday/Christmas gift for letting me quit my job. I know, not the smartest move with the big present, but I wanted to show him how much I appreciated his support. And I’m not a perfect budgeter all the time.

- December: $445 – We paid for Christmas/holidays, but still had a little left to save.

- January: $630 – We paid a lot of medical bills. Since we also attempted our second Zero-spending month, we were still able to save a little overall.

- February: $1,329 – We started benefiting from our new ACA health insurance.

- March: $3,896 – We got our tax refund! When you get a lot of taxes taken out of your paycheck and then quit before the end of the year, you get your biggest tax refund ever! This was the first time since the car accident that we were finally in the black after I quit my job. We’ve saved each month since.

- April: $941 – No big unexpected transactions.

- May: $967 – No big unexpected transactions.

- June: $1,427 – No big unexpected transactions. Lots of summer fun at the pool!

- July: $2,984 – We received my husband’s summer school paycheck and saved it all, plus our usual savings!

- August: $186 – I bought a blogging training course that really cut into our savings this month. This was a tough decision for me. I’m usually very frugal, but my husband agreed that I should invest in myself. I currently make no money as a blogger, but would like to pull my weight a little bit more at some point. Big goals!

Net Income Total for the Year

Then I determined the total net income for the entire year by adding up all the month-by-month numbers. According to our Mint report, we were up about $9,000 over the course of the year. In other words, our income was $9,000 more than our expenses for the year.

On average, that comes to about $750/month SAVED!

Net Assets

(Retirement Accounts, College Fund, Stocks)

According to our Mint report, we were up about $60,000 over the course of the year. Despite putting in less money each month, our accounts continue to grow with interest. Yes, this is mostly all money that we can’t touch right now (without penalties), but we will some day when we reach retirement age!

A comfortable retirement is still within our reach.

In a nutshell

We’re about $69,000 richer than we were a year ago! Two adults, one child, and two cats on just one teacher salary!

That’s more than the teacher salary. Mind blown. ?

As you can see, not only did we make ends meet, but we still had some splurge buys AND continued to save for retirement, our child’s college, and rainy days.

I could not be happier right now!

You guys, this is do-able. If you daydream about quitting your job and doing something more meaningful with your life, you can make it happen. You just have to take steps in the right direction.

It took me about 4 years of “gazelle-intense” debt reduction and budgeting and constantly learning new ways to save, but it happened!

If you’re not keeping a budget yet and are interested in learning, read my post here to get started. That’s the first step in reaching financial freedom- budgeting. You’ve got to know what your money is doing. You control it. Not the other way around.

With a bit of frugal effort, you may be celebrating your one-year quitting anniversary in the future too!

Your friend with the frugal thumb,

Joni S.

P.S. Please let me know if you have any questions or want more details about anything I’ve mentioned above regarding my family’s finances this past year. Like maybe our budget amounts for various categories in our 50/20/30 budget, if you’re interested? I want to help you live happier too without feeling constantly burdened by your financial situation, so if there’s some information that I can provide to make it easier for you, let me know.

3 comments

Thumbs up!!! It only took me about a year to see this…but in my defense it’s been one heckuva bust year, lol. What an excellent article! I’m so happy for you and your family, Joni. It sounds like this was exactly what you needed. 🙂 I am always happy to hear / read that people have followed their instincts and made a life path work for them that they felt particularly drawn to. So many times we get stuck in ruts that we struggle to find our ways out of due to fear. Oftentimes severe illness forces change, whether we choose to take control of the situation (as much as we are able) or not. Your approach is so straightforward, and while it doesn’t remove fear or risk, it definitely serves as an inspiration to others that the important part is that you prepare & you try (relatively methodically). Congratulations on your upcoming 2nd quitiversary!