This post may contain affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a qualifying purchase.

There are so many reasons to use Mint for your monthly budgeting tool. I could spend all day talking about its great budgeting features! But I won’t bore you that long – just long enough to share some of my favorite reasons to use Mint!

Mint is a free online budget tracker and planner.

I started using Mint about 7 years ago, and it allowed me to start budgeting with very little effort. It automated a lot of the work required to keep our budget up-to-date.

Mint also made it easy for me to see what our money was doing and where it was going. I could see where we needed to make changes. It was eye-opening.

It helped me completely transform my family’s financial trajectory. I was able to cut wasteful spending, pay off all of our loans, and ultimately, afford to quit my job.

In short, using Mint to track our monthly budget was life-changing.

If you’re convinced on using Mint for your monthly budget, follow my simple 5-step Mint tutorial to create your first monthly budget in less than an hour: http://frugalthumb.com/mint-tutorial-to-create-monthly-budget.

If you still need some convincing, read on for my top 10 reasons you should use Mint.

Top 10 Reasons You Should Use Mint

I’ve listed about 10 stellar reasons why you should use Mint in this post, and it’s not an exhaustive list by any means. These are just the top 10, in my humble opinion.

Reason 1: Manage all your financial accounts in one place.

Mint gives you a complete financial picture.

It links to your financial accounts, and copies all of your transactions into the site automatically. No more jumping from website to website to check account balances or transactions.

You only have to check this one site to view them all.

And because it pulls in your transactions for you, there’s no need to manually add transactions one at a time either. (Like you would have to do if you were tracking your budget on paper.)

The automation that Mint provides is a budgeting game-changer.

Reason 2: Access your budget from anywhere.

It doesn’t matter if you have a Mac or a PC. And Mint doesn’t care if your phone is Android or iPhone. You just need any web browser, or you can install the Mint phone app.

Reason 3: It’s safe to use.

The Mint.com website is owned by Intuit, the same company that creates Quickbooks, Turbotax, and all the Quicken products (for personal or business financial management).

It has legit credibility when it comes to security too. The Mint website uses the same kind of encryption and safety measures used by online banking sites to keep your information safe.

And you cannot make actual changes to any data on your other financial accounts from within Mint. Any updates you make are to the details that were copied into Mint.

If you want to know more about that, you can read the security information provided by Mint: https://www.mint.com/how-mint-works/security

And in this post comparing Mint to Quicken: https://www.mybanktracker.com/news/mint-vs-quicken-personal-finance-apps-compared

Reason 4: Mint automatically applies budget categories to your transactions.

Mint does its best to guess what category to apply to your transactions. Most of the time, it’s right. And that’s one less thing you have to do yourself to keep your budget up-to-date.

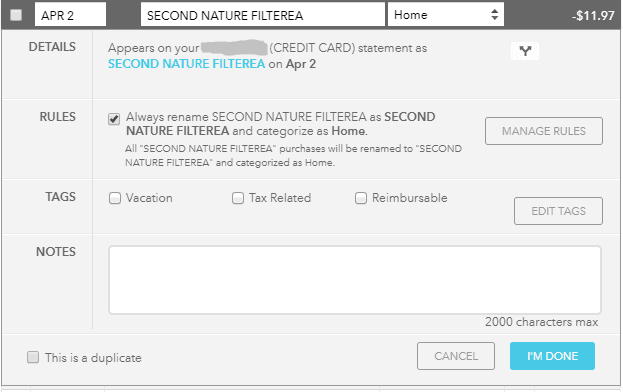

However, if you find that you need to change the category for a transaction, you can tell Mint to remember how you categorized it. Then all future transactions like it will automatically be categorized as you requested.

So it gets smarter over time, again saving you time and requiring less work for you to keep your budget up-to-date.

Reason 5: Split transactions into multiple budget categories.

Let’s say you went shopping at Target and spent $95. However, the items included $50 on home supplies, $25 on a birthday gift, and another $20 on pet food. In Mint, all you have to do is click the “split this transaction” button and you can specify as many dollar amounts and categories as you want, as long as the final total equals the total for the original single transaction.

Reason 6: Mint copies your previous month’s budget as a template for the current month.

This is also a real time saver because, for the most part, you’re probably going to be using mostly the same budget categories each month. You just have to set aside a few minutes to tweak it a little at the beginning of the month.

All it takes is a quick check of each budget category. Ask yourself if you need to update the spending amount set for it, or delete the category entirely. Then add new categories as needed.

This will get faster and the copies of your budget will get better every month as you become more familiar with your spending habits and need less tweaking.

Reason 7: Receive alerts.

You can set up alerts for Mint.com to notify you about various changes to your financial accounts or spending habits.

For example, if there’s an unexpectedly large transaction, you can get an alert. Or if you’ve gone over your budget for a category, it will notify you. You can also get notifications to let you know about upcoming bills, low account balances, unusual spending, bank fees, interest rate changes, and more.

Reason 8: View and filter financial reports.

Mint has so many helpful reports!

You can track your spending and your debts over time. You can view your budget categories as a pie chart showing your spending percentages.

You can even view your net worth over time. And many many more.

Reason 9: Create savings goals.

If you have a big purchase that you need to save up for, you can track your progress by creating a savings goal in Mint.

Not only does Mint help you calculate how much you need to save each month to meet your deadline, but it lets you track the total by linking to your financial accounts.

It even takes these goals into account for your monthly budget and makes sure you plan to save enough for them.

And before you know it, you’ll be reaching those savings goals!

Reason 10: Get your credit score for free.

Every month, Mint will provide your current credit score, free of charge. You can even drill down and see why you have the score you have, and make changes accordingly.

Bonus Reason: It’s FREE!

Yes, that’s right. In case you missed this detail earlier, I’m reminding you again. You get all these features for free!

Mint can afford to be free because they offer ads for things like credit cards and bank accounts on the site. But I find these easy to ignore. So it’s no biggie.

So that’s just my top 10 favorite features available in Mint (plus the fact that it’s free).

As you can see, there are so many undeniably good reasons to get started with Mint!

I hope that I’ve convinced you to try it!

You can even set up your first monthly budget in Mint.com by following my 5-step Mint tutorial. It takes less than an hour, and you’ll be well on your way to becoming a budgeting pro.

If you’re ready to get started, go to the Mint tutorial now: http://frugalthumb.com/mint-tutorial-to-create-monthly-budget