This post may contain affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a qualifying purchase.

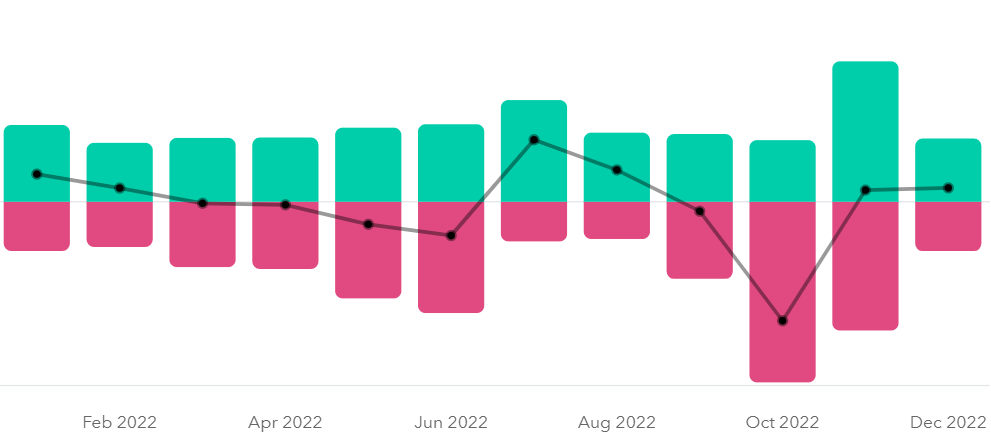

The year 2022 was not a good year for our budget.

I was so optimistic last year when I reviewed my family’s budget for 2021. I mean, who wouldn’t feel good after seeing a savings of around $2,000/month!

But by the time we got a few months into 2022, I was back to full blown panic stressing about whether we could continue to make ends meet if I didn’t get a job. When I reveal our 2022 budget stretchers, you’ll understand why.

And the whole year went this way, with budget stretcher after budget stretcher.

Note: I define budget stretchers as any one-time expense that occurs that was not planned for in the budget. They’re usually big, usually unexpected, and mostly unavoidable. Examples include a car accident, damage from storms, illnesses, random breakdown of appliances, etc.

Since quitting my job, 2022 was the first year that we actually lost money every month on average over the course of the entire year.

And not just a little.

We overspent by $20,700. That’s an average of -$1725/month in 2022… We had blown most of our savings from the previous year.

Needless to say, I was not feeling so hot.

Sure, we’d have bad months here or there, but this was a bad year for our budget.

I knew 2022 was bad while it was happening, but it didn’t go off the rails until October. I wasn’t being as consistent with checking our budget and tweaking as needed on a monthly basis, so I didn’t know how bad the monthly average was until I did my yearly review. (Another great reason to do periodic reviews!)

However, before I go further, I want to let you know the good news–we had an emergency fund. We had been saving every month when times were better. And it came in handy.

The year 2022 was a good lesson in the importance of an emergency fund.

An emergency fund is there to save you when budget stretchers come up.

Because we had an emergency fund, we didn’t go into debt when a lot of budget stretchers happened.

It also really helps to have a sane husband.

What really helped me the most when doing this year’s budget review was my husband.

Let’s just say that I was not feeling at peace when I did my usual yearly review. Calculating that deficit for the year was making me freak out big time!

But my husband gave me some great advice.

He told me to make a list of all the biggest budget stretchers that came up throughout the year. These needed to be the things that were obvious one-off expenses or most likely wouldn’t happen again for many years. Then subtract it from the year’s total net income and see how I felt.

It was a stroke of genius.

By doing that, I was able to determine what our finances would’ve been in 2022 without those budget stretchers. I could calculate how my family’s saving was really doing last year and how it would probably do going forward in the next months this year. (Assuming we would get a break from big budget stretchers for awhile. Please cross your fingers and thumbs!)

So I took his advice. I made the budget stretcher list, added up the total cost for everything in the list, and subtracted it back out of our net income for the year.

Note: For this to work, it was very important that I pare down my list to expenses that most likely wouldn’t occur again for a long time, if ever. And it’s definitely most likely that these expenses won’t happen again this coming year. Plus, based on history, it’s just highly unlikely that we’ll continue having this many budget stretchers one after the other.

Here’s the list of budget stretchers that I included for this husband-suggested calculation.

Budget Stretcher List 2022

| $578 | Pot hole causes flat tire, replaced all 4 tires on car |

| $3467 (1164+2303) | Additional car problems throughout the year |

| $764 (239+525) | Elderly cat vet bills (My sweet old man Qwerty kitty passed away in April) |

| $900 | Fix/replace wood rot on house siding |

| $4456 (2512+1944) | Vinyl siding for front of house where sun causes damage (with the rest to be paid in 2023) |

| $3500 | Painting siding on back and sides of house |

| $1600 | Downed trees in yard after storm |

| $945 | Replaced Lally column in garage after discovering it was rusted out |

| $1284 | Disney vacation (this is in addition to cost spread over previous two years) |

| $10397 (3116+9172) | Solar panels deposit for roof (with the rest to be paid in 2023) |

| $1891 | Plumbing issues including a new water heater |

We had other budget stretchers, but these are the 11 big budget stretchers that I defined as “big expenses that most likely wouldn’t occur again for a long time, if ever.”

TOTAL big and/or unexpected expenses in 2022: $29,782

Then I took that total (-$29,782) and added it back into our total net income (-$20,700).

That’s -$20,700 net income + $29,782 big one-time budget stretchers = $9082 net income for the year, or $757/month.

So what exactly does that $757/month mean?

Well, in other words, I did a what-if scenario where those budget stretchers didn’t happen.

By disregarding those 11 big one-time budget stretchers, my family would’ve saved about $757/month last year.

Yes, I know that’s not what really happened, but it showed me a couple of things:

- we’re still saving a healthy amount of money each month.

- that’s closer to what our savings will be this year when we don’t have so many budget stretchers.

If all goes well, we will have fewer budget stretchers and our budget will get back on track this year.

That was really important for me to realize. Especially when I’m stressing about not bringing in my own income from a job and laying awake at night wondering if I’m ruining my family’s future.

I now know it was just a bad year and things will most likely head in a better direction this year.

And that knowledge allows me to rest easy as this new year unfolds.

Besides my husband, the big hero here was our emergency fund. It allowed us to absorb all these big budget stretchers as they happened without going into debt. And that’s what it’s for.

So, with our currently shrunken emergency fund, we will be focusing on replenishing it in the coming months.

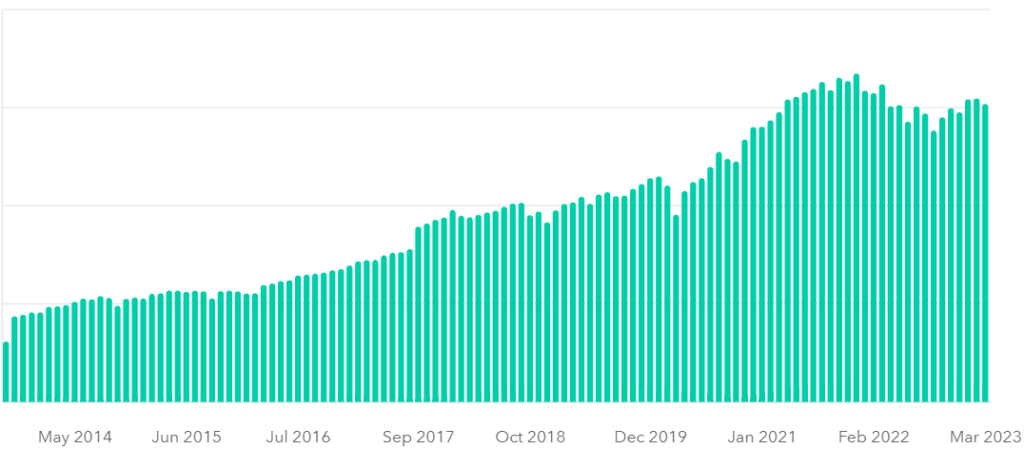

Investments

It wasn’t a good year for our investments either. Our retirement savings and college savings went down with the stock market volatility. It’s down over $55,000.

But I don’t care so much about this. We continue to invest what we can each month and I know the numbers will go back up with time.

In all the years that I’ve been tracking this closely on Mint, the general direction is up.

In fact, I took a look at the Net Assets report, filtered by “All Time” and it’s much easier to see that time has healed all dips in the chart. This latest one is already starting to trend back up.

So, I’m not worried about this 2022 finance bummer either. It’ll get better.

Our One-Salary Family Budget Results in a nutshell

It wasn’t a great year for our budget. We had a lot of big one-time expenses.

However, we learned the importance of our emergency fund. And we’re still saving well each month–even if it all went to our budget stretchers last year. Going forward, our consistency should have things looking up this year.

It’s now been 5 years of living as a one-teaching-salary family. (That’s for two adults, one child, and three cats on just one elementary school teacher salary!) And it’s a relief to know that we’re still okay even after a bad year. It’s going to be okay and we still don’t need my old salary. We can continue to do this.

Emergency fund for the win.

Thank you for reading. If you liked this post, please let me know in the comments below. I love hearing from others who are budgeting and trying to be thrifty and green. Have a great day!