This post may contain affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a qualifying purchase.

Four years after quitting my job, I am the happiest I’ve ever been. This past year was the year that I finally started to release all that guilt from quitting and really feel at peace with my decision. In fact, I think I started feeling a real, all-encompassing joy in just the last couple of months. And tracking our budget results has made that possible.

It has been freeing!

I know, I know. You’re probably wondering what in the world I’m talking about. What exactly was still worrying me? Why did it take me so long to enjoy my “retirement” when I knew that our family was doing fine on one salary? After all, I have been sharing our family budget results for 3 years now.

Well, it might sound like it was easy to quit my job, but it wasn’t. My husband used to joke that I was his sugar mama. At one point, I was bringing home nearly twice as much bacon as him. That was a lot to let go despite the work stress.

And after I actually quit, the guilt weighed really heavily on me. It didn’t seem fair that my husband had to take on all of the financial burden.

So I had these grand plans to eventually make up my old salary. I didn’t know how I was going to do it, but I had it in my head that I needed to create the ability for my husband to retire too whenever he was ready, even though he had no desire to retire yet.

I kept putting all this added pressure on myself that stemmed from my own money hang-ups. And that pressure was making me feel stressed and overwhelmed. I’d freak out thinking I needed to be doing more with my blog or find other ways to bring in more money. (Full disclosure: I make pennies a day from blogging.)

When I watched Disney’s Encanto for the first time, I got goosebumps and teared up during Luisa’s solo about pressure. It was just so spot on. I can’t not share this amazing song:

Then a couple of eye-opening things happened:

- I did another family budget review and discovered we were saving money yet again – in my fourth year with no job.

- And then I researched my husband’s retirement plan and found that he could retire in just 8 years if he so chose, and we’d still be financially free. The option existed.

P.S. If you haven’t heard my story about why I quit my job in 2017, you can get the backstory here.

Read on to see how the year went in more detail. I list my family’s biggest unexpected expenses/savings, calculate our net income, and check in with our retirement investments.

Here’s my reflection on the year 2021, my 4th quit-iversary.

What were the biggest financial surprises throughout the year?

I like to go through each month of the year and make a list of both the biggest budget stretchers and the biggest budget savers. These were the big things not planned for in the budget. I do this exercise to help me review the year in my own mind and track those financial turning points. (It’s not really necessary to do this step in order to calculate how well we did financially for the year, but I still recommend it.)

Large and/or Unexpected Expenses in the Past Year

First, I compiled a list of our budget stretchers.

Note: I define budget stretchers as any one-time expense that occurs that was not planned for in the budget. They’re usually big, usually unexpected, and mostly unavoidable. Examples include a car accident, damage from storms, illnesses, random breakdown of appliances, etc.

So here’s the list of our main budget stretchers from January 2021 through December 2021:

- Senior Cat Chronic Kidney Disease costs: -$2100

- Family Travel: -$1000

- Dental Bills for Broken Tooth: $200

- New Phones: -$1378

Total: $4678

Unexpected Savings/Income in the Past Year

And then I compiled a list of our budget savers. These are big unexpected boosts to your income, usually tax breaks, overtime pay, inheritance, summer jobs, etc.

We had a few helpful bumps throughout the year from our federal and state governments sending stimulus checks and giving tax breaks because of COVID:

- Stimulus checks from IRS: $6000

- Federal and State Tax Refund: $3160

Total: $9065

Looking at our large and/or unexpected expenses versus our unexpected savings and income was comforting this year. But it’s just a small part of the story.

The really important thing is to look at our Net Income. That’s our Income minus Expenses and really shows how much we saved-or didn’t.

So how do I do that? Luckily, mint.com makes this really easy.

Note: Mint.com is how I keep track of all this budgeting information for our family. I do our entire yearly budget review with numbers I’ve pulled from our mint.com reports. I am able to easily track and review all these budgeting statistics solely because of mint.com–it would be too difficult and time-consuming otherwise. It’s a free website made available by Intuit, the same folks who make Quicken. And it aggregates most all of our financial accounts automatically. I highly recommend it. In fact, you can read my top 10 reasons to use Mint for budgeting and learn how to quickly set it up and start using it for tracking your budget in my Mint tutorial.

For each month, did we lose or save money?

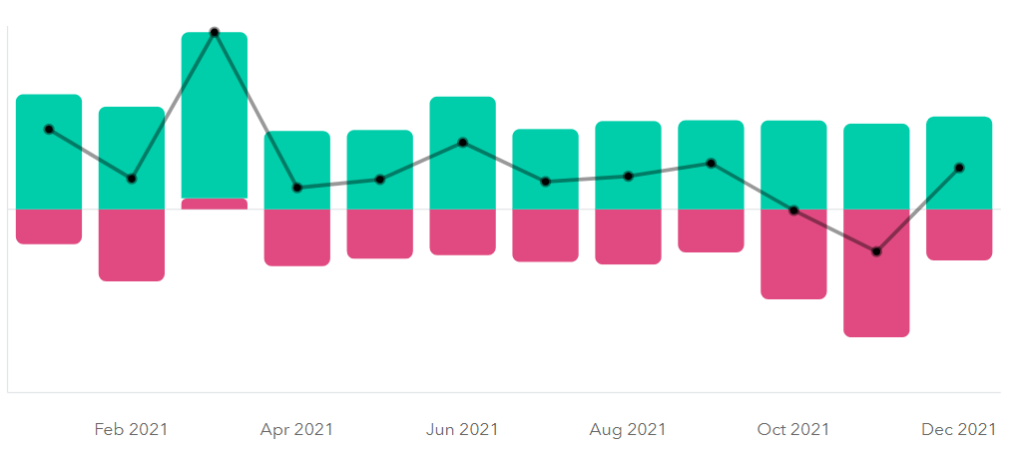

In Mint, I looked at the following report: “Trends>Net Income>Over Time” and filtered by “Last Year.”

Here’s a screenshot of our Net Income report:

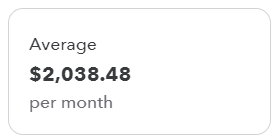

At the bottom of this report, there is a table with all of the numbers, plus this little highlighted box:

We saved a completely unexpected $2038 per month in 2021! These budget results were the best yet since quitting my job 4 years ago.

To put it in perspective, that’s nearly what we saved each month throughout my first TWO quit-iversaries ($750) and my third quit-iversary ($1359) COMBINED!!!

It was also nice to calculate that if the government hadn’t been as helpful, we still would’ve been okay (with a savings of $1283/month). Though I’m still grateful for that help as we can bulk up our emergency fund with it.

Update: (from my future self in February 2023) It turns out that the stimulus came in handy for my family–we just needed it in 2022. I’m very grateful that we had an emergency fund.

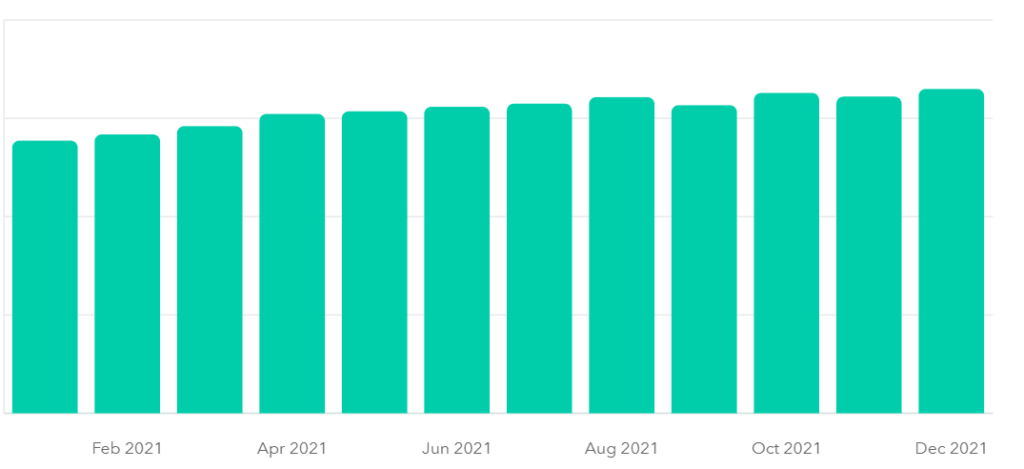

Now that I could rest easy about our net income for the year, I still needed to check our other future-preparing savings accounts. For this, I used the “Assets over Time” report in Mint.

Net Assets

(Retirement Accounts, College Fund, Stocks)

I took a look at our other investment accounts to make sure that we were still on track to save enough for college and retirement.

More good news! According to our Mint report, we were up about $131,000 over the course of the year. (To calculate this, just take the December Asset total and subtract the January Asset total to get your total saved for the year.) We stayed the course and continued to invest all year and it made all the difference.

We still aren’t putting in as much money each month as we used to, but our retirement accounts and college fund for our daughter continue to grow with interest. Yes, this is mostly all money that we can’t touch right now (without penalties), but we will some day!

Affordable college and comfortable retirement are still within our reach.

Our One-Salary Family Budget Results in a nutshell

It was another successful year of budgeting!

Our budget results show that our net worth is $184,000 more than 12 months ago! (In Mint, look at “Trends>Net Worth>Over Time” and filter by “Last Year”.) That’s for two adults, one child, and three cats on just one teacher salary!

That’s more than TRIPLE the teacher salary. Mind blown. Again. ?

As you can see, not only did we make ends meet, but we still had some splurge buys, family fun AND continued to save for retirement, our child’s college, and emergencies.

After 4 years of living as a one-teaching-salary family, it feels good to know that we don’t need my old salary. We can continue to do this. Our budget results are proof!

If quitting your job and living as a one-salary family is something you dream about, you can make it happen too.

Don’t know where to start? Read my post here about making a budget. That’s the first step in reaching financial freedom- budgeting.

You’ve got to know what your money is doing. And then you can start telling it what to do.